2025 Advocacy Priorities

The Michigan Public Transit Association’s highest priority is to ensure that the state of Michigan fully funds Local Bus Operating (LBO) responsibilities.

- The LBO is the state budget line directed to Michigan’s local transit agencies to support essential daily rides for tens of thousands of Michiganders to work, school, medical appointments, families, and more.

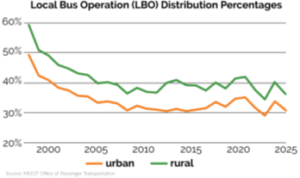

- Despite growing recognition of the need for expanded transportation options, Michigan’s local bus systems are currently at their lowest-ever level of state support - with reimbursement rates of just 30% (for urban agencies) and 35% (for nonurban agencies).

- Local bus systems risk seeing another significant drop in support next year – with estimated reimbursement rates of just 26% (for urban agencies) and 30.6% (for nonurban agencies) in FY26.

- Faced with rising costs and a continued increase in bus services competing for state support, many local bus systems are confronting cuts to critical staffing and services.

- Under Public Act 51, the LBO is fully funded at 60% (urban) and 50% (nonurban) of eligible local transportation expenses.

- Fully funded bus support would require an estimated $423 million for FY25 and $440 million for FY26, or an additional $200 million infusion above current funding levels.

The MPTA specifically calls on the Governor and Legislature to:

- Provide at least $15 million in supplemental funding support to help restore LBO levels in the current fiscal year

- This ensures that bus systems can make it through the immediate year

- Ensure that any “road funding” package includes including local bus operating and other comprehensive transportation modes, consistent with the longstanding formula

- CTF is traditionally a little less than 10% of overall transportation revenues

- Ensure that local bus systems are held harmless if the sales tax on fuels is eliminated

- Approximately $50 million per year in motor fuels sales taxes is apportioned to the CTF

- To achieve this, we strongly advocate increasing the distribution of other auto-related sales taxes to the CTF

- Proposed legislation could provide an additional $325 million per year for CTF – nearly closing the funding gap - without increasing taxes